Loading

Get Inheritance Tax Joint Bank Account Advance Payment Worksheet (rev-548). Forms/publications

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Inheritance Tax Joint Bank Account Advance Payment Worksheet (REV-548) online

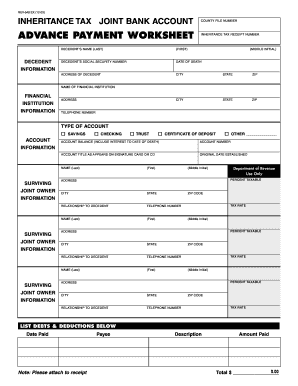

The Inheritance Tax Joint Bank Account Advance Payment Worksheet (REV-548) is an essential document for reporting jointly owned assets to the Department of Revenue. This guide offers clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the worksheet with ease.

- Press the ‘Get Form’ button to access the worksheet and open it in your preferred editor.

- Begin by filling out the decedent information section. Include the decedent's legal name, social security number, date of death, and address.

- Next, provide financial institution information. Fill in the name and address of the financial institution, and include their telephone number.

- Indicate the type of account by checking the appropriate box. List the account balance as of the date of death, including any interest, and provide the account number and title as it appears on the signature card or certificate of deposit.

- For each surviving joint owner, fill in their legal name, social security number, current address, relationship to the decedent, and phone number. If there are multiple owners, use a separate block for each.

- If applicable, list any debts and deductions related to the decedent's death, such as funeral costs or medical expenses. Provide the date paid, payee, description, and amounts.

- After reviewing the completed worksheet, ensure all blocks are filled accurately, then choose to save your changes, download, print, or share the form as needed.

Complete your Inheritance Tax Joint Bank Account Advance Payment Worksheet online today!

Related links form

Joint property, shares and bank accounts You do not usually have to pay any Stamp Duty or tax when you inherit property, shares or the money in joint bank accounts you owned with the deceased.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.