Loading

Get 2012 Individual Return Form - Village Of West Union

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Individual Return Form - Village Of West Union online

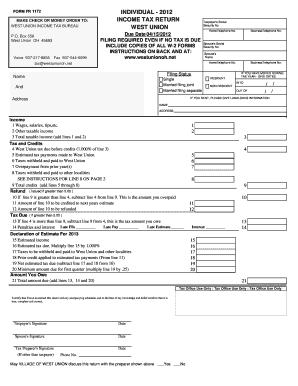

Filing your 2012 Individual Return Form for the Village of West Union is an essential step to ensure compliance with local tax regulations. This guide provides clear and supportive instructions on completing the form online, allowing users to navigate the filing process with confidence.

Follow the steps to effectively complete your individual tax return.

- Press the ‘Get Form’ button to access the 2012 Individual Return Form. Ensure it opens in a suitable online editor for easy filling.

- Begin by entering your Taxpayer's Social Security Number in the designated field. This is important for identification and processing.

- Fill out your personal information, including your name, home telephone number, and if applicable, your spouse’s Social Security Number and name. Specify your filing status, either single, married filing jointly, or married filing separately.

- Indicate your residential status by checking either resident or non-resident. If you moved during the tax year, provide the dates of your move.

- Complete the income section by entering your wages, salaries, and any other taxable income. Ensure you add the totals correctly and refer to your W-2 forms for accuracy.

- In the tax and credits section, calculate your West Union tax due by multiplying your total taxable income by 1%. Fill in the amounts for any estimated payments made and taxes withheld on W-2 forms.

- If applicable, include overpayment or credits from previous years and total these in the relevant lines.

- Determine if you are owed a refund or if you owe additional taxes. Calculate the differences based on the information provided in the previous steps.

- Complete the declaration of estimate section for the following year if necessary, ensuring you estimate your income and taxes accurately.

- Finally, review all entries for accuracy. After confirming everything is complete, save your changes, and choose to download, print, or share the completed form as needed.

Take the next step and complete your 2012 Individual Return Form online today for a seamless tax filing experience.

You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. You don't need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.