Loading

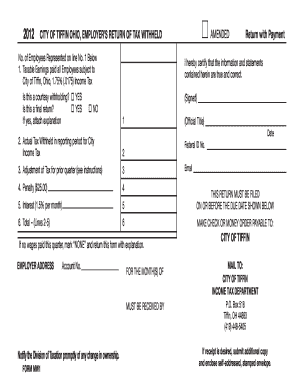

Get W-1 Employer Withholding Form - City Of Tiffin - Tiffinohio

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-1 Employer Withholding Form - City Of Tiffin - Tiffinohio online

Filling out the W-1 Employer Withholding Form is an essential task for employers in Tiffin, Ohio, to ensure compliance with local tax regulations. This guide provides a clear and supportive approach to navigating the form's sections online, making the process straightforward for all users.

Follow the steps to complete the W-1 Employer Withholding Form online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- In Line 1, enter the total compensation paid to all taxable employees during the reporting period. If no compensation was issued, indicate 'NONE' and return the form along with an explanation.

- In Line 2, input the total actual tax withheld from taxable employees during the period for the City Income Tax.

- In Line 3, make any necessary adjustments to the actual tax withheld based on overpayments or underpayments from previous periods.

- In Lines 4 and 5, include any penalties incurred, which is a flat $25.00, and interest accrued at a rate of 1.5% per month on any unpaid amount.

- In Line 6, calculate the total amount to be remitted by summing Lines 2 through 5.

- Review all entries for accuracy, then save changes, download a copy of the completed form, and print if necessary. Ensure to include the signature and the official title, along with the date, on the form.

Start completing your W-1 Employer Withholding Form online today!

Reciprocity Exemption: If you are a resident of Indiana, Kentucky, Pennsylvania, Michigan or West Virginia and you work in Ohio, you do not owe Ohio income tax on your compensation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.