Loading

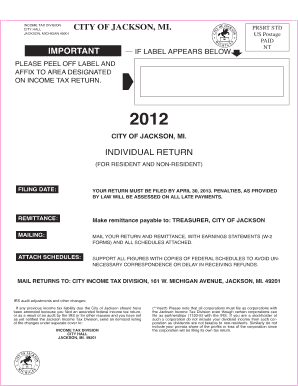

Get 2012 J1040 Form With Instructions - City Of Jackson, Michigan - Cityofjackson

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 J1040 Form With Instructions - City Of Jackson, Michigan - Cityofjackson online

Filing your income tax return can be a straightforward process when you understand the steps needed to complete the 2012 J1040 form. This guide offers a clear and user-friendly approach to filling out the J1040 form for residents and non-residents of Jackson, Michigan, ensuring you meet your tax obligations accurately.

Follow the steps to effectively complete your 2012 J1040 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information, including your Social Security number, name, and address. Ensure that all details are accurate and aligned with official records.

- In the section titled 'Exemptions', indicate any exemptions you are claiming. Multiply the number of exemptions by $600. Include dependents where applicable.

- For 'Total Income', report all taxable income you earned during 2012. After calculating your income, attach copies of W-2 forms and any necessary supporting documents to substantiate your income.

- Complete the 'Additions to Income' and 'Subtractions from Income' sections, utilizing schedules provided if needed. If you have adjustments to your income, make sure to detail them properly.

- Calculate your taxable income by subtracting exemptions and subtractions from your total income.

- Determine your tax liability by applying the respective rates for residents or non-residents on your taxable income.

- In the 'Payments and Tax Credits' section, add up any tax withheld, estimate payments, and credits for taxes paid to other municipalities.

- Finally, review all information for accuracy, sign the return, and save changes. You can now download, print, or share the completed form as needed.

Complete your 2012 J1040 form online today to ensure timely and accurate tax filing!

Since 1970, the City of Jackson is one of 22 cities that have a local income tax. Any citizen of Jackson that makes over $600 a year must file a form and pay 1% to the city. All non-residents that work in the city must file and pay ½ of 1% to our city. All corporations and partnerships are subject to the 1% tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.