Loading

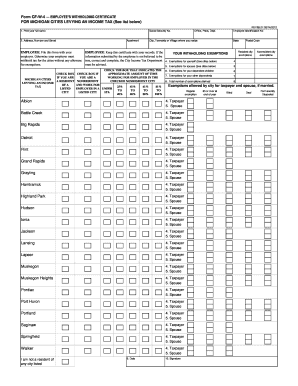

Get Grand Rapids W4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Grand Rapids W4 online

The Grand Rapids W4 is an important document used for income tax withholding in Michigan. Filling out this form accurately is essential for ensuring the correct amount of tax is withheld from your earnings.

Follow the steps to complete your Grand Rapids W4 online.

- Press the ‘Get Form’ button to access the form and open it in your editing tool.

- Begin by entering your full name in the appropriate field.

- Input your Social Security number in the designated box.

- Provide your residential address, including the street number and name, and indicate if you have an apartment.

- Check the box if you are a resident of a Michigan city that levies an income tax.

- Specify the city, township, or village where you reside and ensure the state is correctly filled.

- For the exemptions section, identify the number of exemptions you claim for yourself. Refer to the list of allowable exemptions for each city.

- Next, indicate the exemptions for your spouse, following the same guidelines.

- Complete the section for other dependents, should you have any.

- Sum up the total number of exemptions you are claiming and input this number in the total exemptions field.

- In the nonresident city section, select the approximate percentage of time you work for your employer in the listed city.

- If applicable, check the box indicating if you are not a resident of any city listed.

- Finally, add the date, and sign the form to validate your claim.

- Review all the entered information for accuracy, then save your changes, download the document, print it if necessary, or share it with your employer.

Complete your Grand Rapids W4 online today to ensure proper tax withholding.

Related links form

What cities impose an income tax? CityResidentsNonresidentsHighland Park2%1%Hudson1%0.5%Ionia1%0.5%Jackson1%0.5%20 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.