Loading

Get Instructions Of Where To Mail Gr 1040 Poa Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions Of Where To Mail Gr 1040 Poa Form online

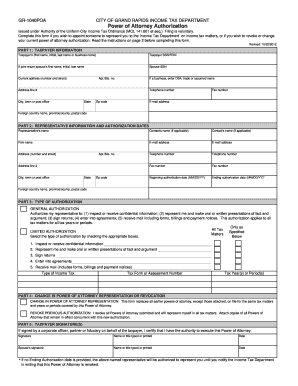

Completing the GR-1040 PoA form enables you to appoint a representative for income tax matters or to change your current power of attorney. This guide provides clear and step-by-step instructions to ensure that you fill out the form accurately and efficiently, allowing for smooth processing.

Follow the steps to complete the GR-1040 PoA form online.

- Click ‘Get Form’ button to obtain the form and access it in your preferred editing application.

- In Part 1, fill in the taxpayer information including the first name, middle initial, last name or business name, and Social Security Number or Federal Employer Identification Number. If filing a joint return, include your spouse's information as well.

- Provide your current address, including the apartment or suite number if applicable, city, state, and zip code. If a business is involved, provide the doing business as (DBA) name.

- In Part 2, enter the representative's details including their name, firm name, and contact information such as telephone number and email address. Specify the beginning and ending authorization dates.

- In Part 3, select the type of authorization by checking the boxes for general or limited authorization according to what actions you wish the representative to take on your behalf.

- If applicable, indicate any specific types of income tax and years or periods related to the authorization.

- In Part 4, specify if you are changing your power of attorney representation or revoking previous authorizations and attach any prior forms if required.

- In Part 5, sign and date the form. If signing on behalf of the taxpayer, include your name or title.

- Review all entries for accuracy and completeness. Once finalized, you can save changes, download a copy, print the form, or share it as needed.

Get started on filing your GR-1040 PoA form online today!

Signing a tax return for a parent You must file a Form 2848 along with your parent's Form 1040. Form 2848 allows your parent to authorize someone to represent him or her before the IRS. As your parent's power of attorney, you can fill out this form if your parent is unable to because of injury or illness.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.