Loading

Get 2014 103 Era Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 103 Era Form online

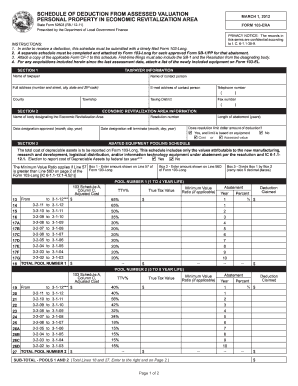

Filling out the 2014 103 Era Form online is an important step for taxpayers seeking deductions within an economic revitalization area. This guide provides a clear and structured process to assist users in accurately completing the form.

Follow the steps to complete the form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- In Section 1, enter the taxpayer information, including the name, contact person, full address, email address, telephone number, taxing district, township, and county.

- Proceed to Section 2 to provide the economic revitalization area information, which includes the name of the designating body, date of approval, resolution number, length of abatement in years, and details about dollar amount limits.

- In Section 3, fill in the abated equipment pooling schedule. Report the total cost of depreciable assets on Form 103-Long. Enter information for each pool of equipment based on the specified years of life.

- Complete any relevant calculations, including the minimum value ratio where applicable, and ensure totals are summed correctly for each pool.

- Review the information entered in all sections for accuracy and completeness.

- Once all fields are filled out and verified, save changes if needed, and download or print the completed form for submission. You can also share it as required.

Complete your 2014 103 Era Form online today for an efficient filing process.

Related links form

State and Local Personal Property Taxes Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it's collected more than once a year or less than once a year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.