Loading

Get Application For City Occupational Tax Form - Lyons, Georgia - Lyonsga

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For City Occupational Tax Form - Lyons, Georgia - Lyonsga online

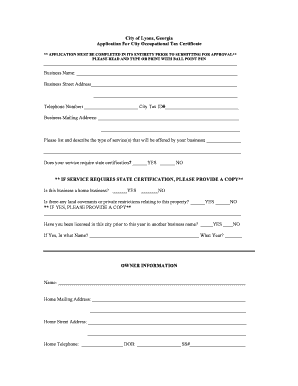

Filling out the Application for City Occupational Tax Form is an essential step for businesses operating in Lyons, Georgia. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the application form.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Enter your business name in the designated field at the top of the form. Ensure that the name accurately reflects your registered business entity.

- Provide the business street address, ensuring to include suite numbers or other identifiers if applicable.

- Input your telephone number and the city tax ID number in the corresponding fields. This information is crucial for the city to identify your business.

- List and describe the type of services your business will offer in the provided section. Be thorough and precise to avoid any issues during processing.

- Indicate whether your service requires state certification. If yes, be prepared to provide a copy as per the instructions.

- Indicate if your business operates from your home by selecting yes or no. If it is a home business, be aware of any related regulations.

- If there are land covenants or private restrictions related to your property, indicate this and provide the necessary copies of any documents.

- If you have previously been licensed in this city under a different business name, check yes and provide the previous name and year of licensing.

- Complete the owner information section, including your name, home mailing address, home street address, home telephone, date of birth, and social security number.

- Review the fee schedule. Calculate the administrative fee and total fee based on the number of employees. Make sure the total amount due is correctly entered.

- Read the affirmations regarding misrepresentation. Ensure that you understand the implications before signing the form.

- Sign and date the application, confirming your acceptance of the terms stated in the form.

- Once you have completed all sections, save your changes, and choose to download, print, or share the form as necessary.

Complete your application online today to ensure timely processing!

Under the revised law, a city or county may levy and collect occupation taxes on businesses and practitioners that have an office or location within the local government jurisdiction. 1. These occupation taxes may be used to raise revenue for the local government.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.