Loading

Get M-55 Form - Bridgeportct.gov - Bridgeportct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M-55 FORM - BridgeportCT.gov - Bridgeportct online

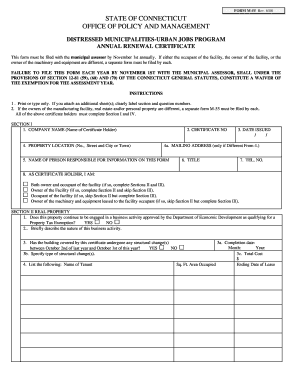

Filling out the M-55 form is essential for maintaining your property tax exemption as part of the Distressed Municipalities-Urban Jobs Program in Connecticut. This guide will provide you with step-by-step instructions to ensure your form is completed accurately and submitted on time.

Follow the steps to efficiently complete the M-55 form.

- Press the ‘Get Form’ button to obtain the M-55 form and open it for editing.

- In Section I, fill out the Company Name, Certificate Number, and Date Issued. Make sure to provide the correct Property Location. If there is a different mailing address, include that as well. Identify the person responsible for the information by entering their Name, Title, and Telephone Number. Specify your role as either owner and occupant, owner only, occupant only, or owner of the machinery.

- For Section II, answer whether the property continues to engage in a business activity eligible for property tax exemption. If yes, describe the business activity briefly. Provide the completion date, total cost, square footage occupied, and any ending lease dates. Indicate if there have been any structural changes to the building since the last filing.

- In Section III, confirm if you still participate in a qualifying business activity and provide a description. Report if any machinery or equipment was removed and attach corresponding details about the item, disposal date, and transferee. Also, indicate if any equipment from the Future Acquisition list was added and provide relevant costs and acquisition dates, attaching invoices as necessary.

- In Section IV, review the affidavit statement. Sign and date the form. Ensure that your certification is complete and accurate before submitting it to the municipal assessor.

- Once all sections are completed, save your changes to the form. You can then download, print, or share the filled-out form as required or submit it directly to the municipal assessor by the deadline of November 1st.

Begin completing your M-55 form online to secure your property tax exemption today!

Related links form

For Fiscal Year 2021-2022 it is 43.45 mills for Real Estate, Personal Property and Motor Vehicles. Mill rate history: mill rate fiscal year 2021-2022: 43.45. mill rate fiscal year 2020-2021: 43.45.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.