Loading

Get Self Calculating Sales Tax Form - Black Hawk - Cityofblackhawk

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self Calculating Sales Tax Form - Black Hawk - Cityofblackhawk online

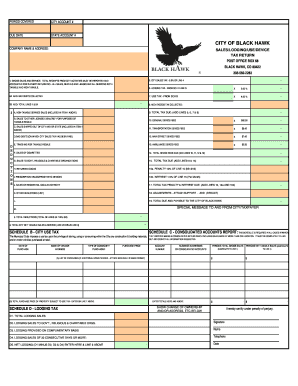

Filling out the Self Calculating Sales Tax Form for Black Hawk is a crucial step for individuals and businesses to accurately report their sales tax obligations. This guide offers a detailed walkthrough of each section of the form to ensure users can complete it correctly and efficiently.

Follow the steps to successfully complete the online form.

- Click ‘Get Form’ button to access the Self Calculating Sales Tax Form and open it in your editing tool.

- Begin with the 'Period Covered' section, specifying the time frame for which you are reporting sales tax. Ensure your entries are accurate to avoid future discrepancies.

- Complete the 'City Account #' and 'State Account #' fields with your respective identification numbers. This helps in accurately attributing your sales to the correct accounts.

- Fill in your 'Company Name & Address,' making sure it's consistent with the information on file with the City of Black Hawk.

- Move to the 'Gross Sales and Service' section. Here, report total receipts from all City activities, including taxable and non-taxable sales. Ensure to accurately sum up all sales, rentals, leases, and services.

- In the deductions section, enter any applicable values, such as bad debts collected and sales to licensed dealers. This will reduce your overall taxable sales.

- Proceed to calculate the total city sales tax based on the provided percentages, ensuring all figures are correctly inputted and calculated in the form.

- Review all calculated taxes and fees, including lodging and use taxes, and input totals into the designated fields.

- Complete the 'TOTAL DUE AND PAYABLE TO THE CITY OF BLACK HAWK' section. This figure represents your total tax obligation.

- After verifying all information for accuracy, you will have options to save changes, download, print, or share your completed sales tax form.

Take action and complete your Self Calculating Sales Tax Form online today.

Seven states (Delaware, Nevada, Ohio, Oregon, Tennessee, Texas, and Washington) currently levy gross receipts taxes, while several others, including Pennsylvania, Virginia, and West Virginia, permit local taxes imposed on a gross receipts base.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.