Loading

Get Sebastopol Occupancy Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sebastopol Occupancy Tax Form online

Filling out the Sebastopol Occupancy Tax Form online can simplify the process of reporting your transient occupancy tax. This guide provides clear and precise instructions to help you navigate each section of the form with confidence.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to obtain the Sebastopol Occupancy Tax Form and open it in your preferred editor.

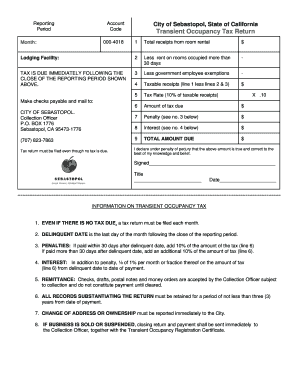

- In the 'Reporting Period' section, enter the specific month for which you are reporting. This is crucial for accuracy.

- Locate the 'Account Code' field and enter your unique account code (e.g., 000-4018) assigned by the city.

- Under 'Total receipts from room rental', input the total earnings from room rentals for the reporting period.

- For 'Less rent on rooms occupied more than 30 days', subtract any rent collected from long-term stays from your total receipts.

- In the 'Less government employee exemptions' section, enter any exemptions for stays by government employees.

- Calculate 'Taxable receipts' by taking the total from step 4 and subtracting the amounts entered in steps 5 and 6.

- Determine the 'Tax Rate', which is 10% of the taxable receipts calculated in the previous step.

- Fill in the 'Amount of tax due' by providing the computed tax amount from the previous step.

- If applicable, include any 'Penalty' for late payments according to the guidelines provided.

- Add any 'Interest' due based on the timetable specified in the instructions.

- Calculate the 'Total amount due' by summing the tax due, penalties, and interest.

- Sign the form in the designated area, providing your title and the date of signing.

- Once all sections are completed, save your changes, download the form, and print it if necessary for your records.

- If you wish to share or send the form, ensure you have all necessary documentation attached.

Complete your Sebastopol Occupancy Tax Form online today to ensure timely and accurate reporting.

Any person who has a written agreement with the operator, entered into within the first thirty (30) days of the person's occupancy, which states the person will stay for more than thirty (30) consecutive calendar days is exempt from the TOT, for the first 30 days of the person's stay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.