Loading

Get Srs Declaration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SRS Declaration Form online

Filling out the SRS Declaration Form online can be a straightforward process when you follow the right steps. This guide provides detailed instructions for completing the necessary sections of the form effectively, ensuring that you meet all requirements.

Follow the steps to complete your SRS Declaration Form online

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

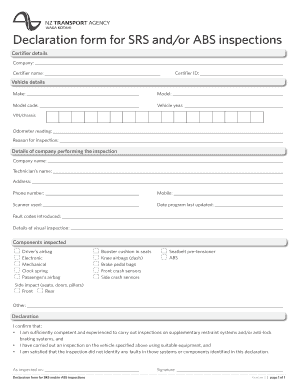

- Enter the certifier details. Provide the company name, certifier name, and certifier ID accurately to ensure proper identification.

- Fill in the vehicle details. This includes the make, model, model code, vehicle year, VIN/chassis number, odometer reading, and reason for inspection. Ensure all entries are correct to avoid issues later.

- Complete the details of the company performing the inspection. This section requires the company name, technician's name, address, phone number, mobile, scanner used, and the date the program was last updated. Precision is key here.

- Document any fault codes introduced and details of the visual inspection. This ensures transparency and accuracy in the inspection process.

- Review and check all components inspected, which include various airbags, sensors, and seatbelt pre-tensioners. Mark all that apply to confirm comprehensive checks were made.

- In the declaration section, confirm your competency to perform the inspection, and that you have done so using suitable equipment, ensuring no faults were found. Enter the inspection date and provide your signature.

- After completing the form, save your changes, and consider downloading, printing, or sharing the form as needed to keep a record of your submission.

Complete your SRS Declaration Form online today for a seamless inspection process.

Before the retirement age at first contribution, withdrawals from your DBS SRS Account at any time are subjected to a 5% penalty and 100% of the amount withdrawn will be taxable for that year. Upon retirement age at first contribution, you are allowed to spread out your withdrawals over 10 years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.