Loading

Get Vat1c Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat1c Form online

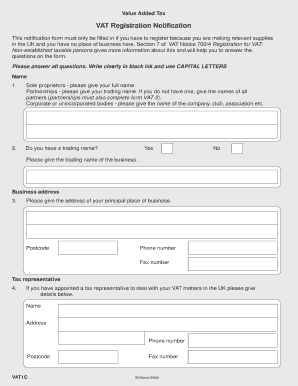

The Vat1c Form is essential for individuals and organizations that need to register for Value Added Tax (VAT) in the UK, particularly those without a local place of business. This guide provides clear, step-by-step instructions for successfully completing the form online.

Follow the steps to fill out the Vat1c Form accurately.

- Click ‘Get Form’ button to obtain the Vat1c Form and open it for editing.

- Provide your full name if you are a sole proprietor. For partnerships, input your trading name, or list the names of all partners if no trading name exists. If you represent a corporate or unincorporated body, enter the name of that entity.

- Indicate whether you have a trading name by selecting 'Yes' or 'No' and, if applicable, provide the trading name of your business.

- Complete the business address section by supplying the principal place of business, including postcode, phone number, and fax number.

- If you've appointed a tax representative in the UK, fill in their details, including name, address, phone number, and postcode.

- Select the legal status of your business by ticking the appropriate option: sole proprietor, partnership, corporate body (include incorporation details), or unincorporated body.

- Describe your current or intended business activities in the provided section.

- Enter your UK bank details or those of your tax representative, including sort code and account number. If you do not have a bank account, indicate this by ticking the relevant box.

- State whether your accounting system is computerized by selecting 'Yes' or 'No.' If 'Yes', provide details such as computer type and software version.

- Indicate if you have made any relevant supplies. If so, provide the date of your first relevant supply. If not, state the expected date of your first supply.

- Estimate the value of relevant supplies you expect to make in the next 12 months and input that figure.

- Answer if you make any other taxable supplies in the UK and provide the expected value of those taxable supplies for the next 12 months if applicable.

- Indicate if you are registering due to VAT recovery by a predecessor and provide relevant names and addresses if necessary.

- Select if you want exemption from registration due to wholly zero-rated relevant supplies and provide the expected value of those supplies.

- If you or any other partners or directors have been involved in other businesses in the past five years, provide their names and VAT registration numbers as applicable.

- Complete the declaration section by signing, dating, and including your full name and position within the business.

- Review the checklist to ensure you have answered all questions, signed the form, and completed any additional forms if you are in a partnership or need a tax representative.

- Once the form is fully completed and signed, submit it to the VAT Registration Unit as specified in the relevant VAT notice.

Start filling out your Vat1c Form online today to ensure your VAT registration process is complete.

You can choose to register for VAT if your turnover is less than £85,000 ('voluntary registration'). You must pay HM Revenue and Customs ( HMRC ) any VAT you owe from the date they register you. If everything you sell is exempt from VAT, you do not have to register for VAT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.