Loading

Get W5 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W5 Form online

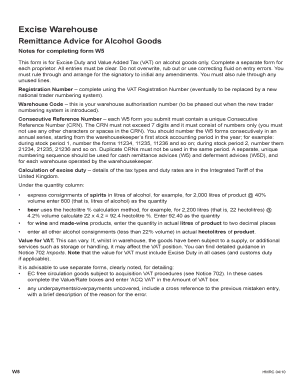

This guide provides a comprehensive overview of how to accurately complete the W5 Form online for excise duty and value added tax on alcohol goods. Follow the steps outlined here to ensure your form is filled out correctly and submitted without issues.

Follow the steps to successfully complete the W5 Form.

- Click ‘Get Form’ button to obtain the form and open it in the designated online editor.

- Begin by entering the proprietor details. Include the name and address of the proprietor as accurately as possible.

- Next, fill in the warehousekeeper details, including their name and address. Make sure this is consistent with the records.

- Locate the 'Consecutive Reference Number' field and input a unique reference number not exceeding seven digits. Ensure this number is used consecutively for each submission throughout the year.

- Input the proprietor and declarant registration numbers. If they are different, ensure both fields are completed correctly.

- Enter the warehouse code, which serves as your warehouse authorization number.

- Proceed to the 'Calculation of Excise Duty' section. Here, detail the tax type, quantity, rate of duty, and amount of excise duty for each entry.

- For the 'Value for VAT' field, calculate and enter the appropriate amount, making sure it includes any excise duty as applicable.

- Complete the declaration section by typing the name in capital letters, signing the form, and providing a contact number. This section confirms that the information is true and complete.

- Finally, review the entire form for accuracy. Save changes, and then download, print, or share the completed form as necessary.

Complete your W5 Form online today to ensure timely and accurate compliance with excise duty regulations.

Those filing for tax year 2018 used (and still should use) Schedule 5 for Other Payments and Refundable Credits. You should attach this form to Form 1040 when filing for tax year 2018 and include any applicable credits in these areas: Estimated tax payments for 2018. Net premium tax credit (attach Form 8962)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.