Loading

Get Cis302

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cis302 online

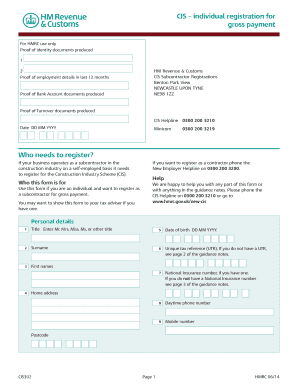

Filling out the Cis302 form is an essential step for individuals seeking to register as subcontractors under the Construction Industry Scheme (CIS). This guide will help you navigate each section of the form with clarity and precision.

Follow the steps to complete the Cis302 form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal details. This includes your title, surname, first names, date of birth, unique tax reference (UTR), national insurance number (if applicable), and your contact numbers.

- Fill in your home address, ensuring that you include the postcode.

- Provide details regarding your employment history in the UK construction industry, including the date you began working in this sector, your type of work, and your trading address if different from your home address.

- Conduct the turnover test. Indicate your gross income from construction work, cost of materials, and ensure your net turnover meets or exceeds £30,000 for gross payment eligibility.

- Complete the business details section by providing the name of your business account, sort code, and account number.

- Confirm your employment status over the past 12 months and provide a reason if you have not been fully employed or self-employed.

- If applicable, mention your employer details and account office reference.

- Sign the declaration stating that your information is correct and complete, then add the date.

- Submit your completed form as per the instructions provided at the end, ensuring you have the required documents ready for any follow-up.

Complete your Cis302 form online to ensure your registration as a subcontractor in the construction industry.

Deductions suffered by a sole trader or partnership are treated as a payment on account of the tax due on their profits. In contrast, deductions suffered by a company are treated as a payment on account of that company's liabilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.