Loading

Get Sdlt1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sdlt1 form online

The Sdlt1 form is essential for reporting land transactions and calculating the appropriate stamp duty. This guide will provide you with a step-by-step process for completing the form online, ensuring you navigate each section with confidence.

Follow the steps to complete the Sdlt1 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

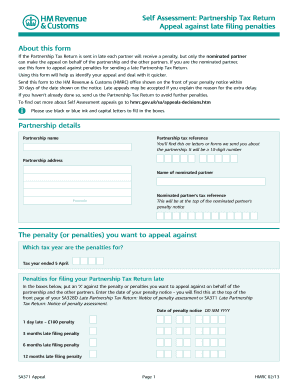

- Begin by entering the partnership details. Fill in the partnership name and tax reference number, which can be located on previous correspondence from tax authorities.

- Next, complete the partnership address and provide the name of the nominated partner, along with their tax reference, which is also found on their penalty notice.

- Indicate the applicable penalties by placing an 'X' next to each penalty you are appealing against. Make sure to include the date of your penalty notice.

- Provide a detailed reason for your appeal in the designated space, explaining circumstances that led to the late filing. Include relevant dates and any supporting evidence.

- Ensure that you sign and date the appeal form. Include your daytime phone number, name, and address.

- If you are not the nominated partner, indicate your capacity (e.g., agent, executor) in which you are signing the appeal.

- Review the form for completeness and accuracy before saving changes, downloading, or printing the form. Share it as necessary with relevant parties.

Complete your documents online today to ensure timely submissions and avoid penalties.

Push Permission Behaviors If a user has already granted permission on an older Android OS (12-), they will not be prompted again. If a user installs the app on an Android 13 device, notifications are in the “don't allow” state by default. The user must grant permission before any notifications will be sent to them.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.