Loading

Get R185 Settlor Interested Trust Statement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R185 Settlor Interested Trust Statement Form online

This guide will provide you with a clear and straightforward approach to completing the R185 Settlor Interested Trust Statement Form online. By following these steps, you will ensure that you accurately report the income arising to the trust while maintaining compliance with tax regulations.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

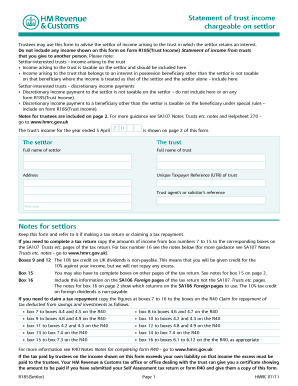

- Begin by entering the full name of the settlor in the designated field. Make sure this information is accurate and reflects official documents.

- Next, provide the full name of the trust. It is essential to use the exact name as registered with the relevant authorities.

- Input the complete address associated with the trust, including the postcode, to ensure proper identification.

- Along with the address, include the Unique Taxpayer Reference (UTR) of the trust. This reference number is crucial for tax purposes.

- If applicable, include the trust agent’s or solicitor’s reference in the designated section.

- Proceed to fill out the income details for the trust for the year ending 5 April. Be mindful of which income is chargeable to the settlor, ensuring you only include taxable income.

- Complete the fields as instructed, including net amounts, tax paid, and any relevant tax credits. Ensure accuracy to facilitate correct tax reporting.

- Review all entries for completeness and correctness. It's recommended to cross-check with any accompanying documents.

- Finally, save your changes, and choose to download, print, or share the form as required. This will ensure that you have a copy for your records and future reference.

Complete your R185 Settlor Interested Trust Statement Form online today to ensure timely and accurate filing.

Related links form

Your P60 shows the tax you've paid on your salary in the tax year (6 April to 5 April). You get a separate P60 for each of your jobs every tax year. There's a separate guide to getting P60s if you're an employer. If you're working for an employer on 5 April they must give you a P60.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.