Loading

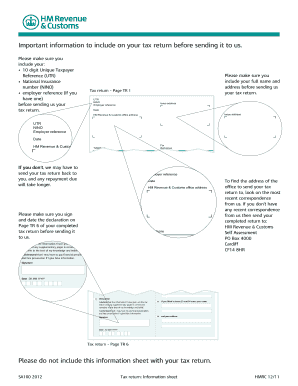

Get Tax Return (2012). Use Form Sa100(2012) To File A Tax Return, Report Your Income And To Claim Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Tax Return (2012). Use Form SA100(2012) To File A Tax Return, Report Your Income And To Claim Tax online

Filing your tax return can be a straightforward process when you understand the necessary steps. This guide provides a comprehensive overview of how to fill out Form SA100 (2012) effectively online, ensuring you report your income accurately and claim any tax refunds you may be entitled to.

Follow the steps to complete your tax return online.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Begin by entering your personal details including your full name, address, and date of birth. Ensure that all information is accurately represented, as this helps in processing your return correctly.

- In the section for Unique Taxpayer Reference (UTR) and National Insurance Number (NINO), ensure you enter these identifiers accurately. If you have a tax adviser, you may optionally include their details in the corresponding sections.

- Report your income, including any taxable UK interest, pensions, and other state benefits received during the tax year from 6 April 2011 to 5 April 2012. Remember to enter your figures in whole pounds, rounding down income and rounding up expenses.

- If applicable, complete any supplementary pages for specific income types, such as self-employment or property income, as required by your individual financial situation.

- Make sure to fill in any deductions or tax reliefs you are entitled to, such as Gift Aid payments or payments to pension schemes.

- Finally, review the entire form for any errors or omissions. If everything is correct, sign and date your declaration at box 22 confirming that the information provided is true and complete.

- Once all sections are completed and reviewed, save your changes. You can then download, print, or share your completed tax return as needed.

Start filing your tax return online today to ensure a smooth tax process.

Taxpayers can request a copy of a tax return by completing and mailing Form 4506 to the IRS address listed on the form. There's a $43 fee for each copy and these are available for the current tax year and up to seven years prior.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.