Loading

Get What Is P11d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is P11D online

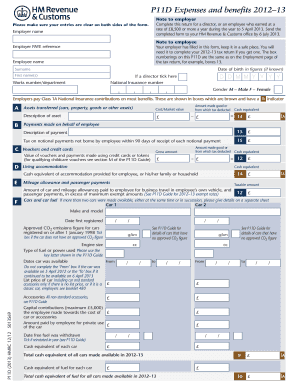

Filling out the P11D form can seem complex, but understanding its components and the steps required can simplify the process. This guide will help you navigate through each section of the form efficiently.

Follow the steps to complete your P11D form online with ease.

- Press the ‘Get Form’ button to access the P11D form and open it in your document editor.

- Begin by entering the employer name at the top of the form. Ensure to fill in the employer PAYE reference as well.

- Next, enter the employee name, date of birth, and National Insurance number, ensuring all details are recorded clearly.

- If applicable, tick the box indicating whether the person is a director.

- Proceed to section A to detail any assets transferred, including the cost or market value, description of assets, and the cash equivalent.

- Continue to section B and C to describe any payments made on behalf of the employee and any vouchers or credit cards issued.

- In section D, provide information regarding living accommodations offered to the employee, including the cash equivalent.

- For mileage allowance in section E, record the taxable amount along with any excess passenger payments.

- Complete sections F, G, and H regarding cars, vans, and their fuel cash equivalents, including necessary details for each vehicle.

- In section I, detail any private medical treatment or insurance provided to the employee.

- If relevant, address any qualifying relocation expenses in section J, ensuring to list any amounts exceeding £8,000.

- Proceed through sections K to N, entering relevant benefits, payments, and expenses on behalf of the employee, ensuring to clarify cost and tax implications where needed.

- Finally, review all entered details for accuracy, save your changes, and then proceed to download, print, or share the completed form as necessary.

Start filling out your P11D form online today for a seamless experience.

As an employee, you pay tax on company benefits like cars, accommodation and loans. Your employer takes the tax you owe from your wages through Pay As You Earn ( PAYE ). The amount you pay depends on what kind of benefits you get and their value, which your employer works out.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.