Loading

Get Iht417

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht417 online

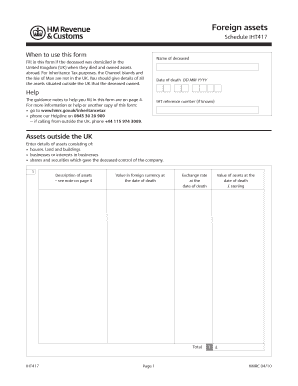

Filling out the Iht417 is essential for declaring foreign assets owned by a deceased individual domiciled in the United Kingdom. This guide provides clear, step-by-step instructions to assist users in completing this important form accurately.

Follow the steps to fill out the Iht417 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the deceased in the designated field, followed by their date of death in the format DD MM YYYY.

- If you have an IHT reference number, please enter it in the appropriate section; otherwise, proceed to the next step.

- Provide details of the foreign assets the deceased owned, including houses, land, buildings, businesses, and securities that offered control of a company. Fill in the description, value in foreign currency at the date of death, and exchange rate.

- Calculate the total value of the assets and record it in the designated box.

- Detail any liabilities to be deducted from the foreign assets in the respective section. Enter the description, value in foreign currency, and exchange rate, then calculate the total liabilities.

- Determine the net assets by subtracting the total liabilities from the total value of foreign assets. If the amount is negative, enter '0'.

- List any exemptions or reliefs being deducted against the foreign assets. Provide the description and amount of each exemption, especially for charity exemptions, which require additional information about the charity.

- Calculate the amount of liability and ensure proper recording of net totals for foreign houses, businesses, and control holdings, as well as for other foreign assets if applicable.

- Review all entries for accuracy. Finally, save changes, download, print, or share the completed form as needed.

Start filling out the Iht417 online to ensure a smooth process for declaring foreign assets.

Related links form

You must complete the form IHT400, as part of the probate or confirmation process if there's Inheritance Tax to pay, or the deceased's estate does not qualify as an 'excepted estate'.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.