Loading

Get N10 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the N10 Form online

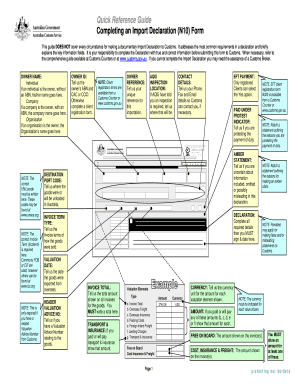

The N10 Form is essential for making an import declaration to Customs. This guide provides clear, step-by-step instructions for filling out the N10 Form online, ensuring you accurately complete each necessary field.

Follow the steps to effectively complete the N10 Form online.

- Press the ‘Get Form’ button to retrieve the form and open it in your editing tool.

- Begin by entering the owner's name in the designated field. Specify whether the owner is an individual, company, or organization. If the owner is an individual who does not have an Australian Business Number (ABN), write their name. If a company is the owner, input the company name along with the ABN.

- Provide an Owner ID. If applicable, include the ABN and the Client ID. If you do not have an ABN or ID, fill out a client registration form available online.

- Fill in your unique reference for this importation in the Owner Reference section.

- If an AQIS inspection is required, mention the location specified by AQIS.

- Enter your contact details, including your phone number, fax number, and email, to allow Customs to reach out to you if needed.

- Complete all required details in the declaration section before signing and dating the form.

- Indicate the invoice term type by selecting how the goods were sold, using standard terms.

- If applicable, fill in the Header Valuation Advice Number related to your goods.

- Address whether you are protesting the payment of duty by checking the appropriate box.

- In the Amber Statement section, document any uncertainty about the information provided in the declaration.

- Specify the destination port code where the goods will be unloaded in Australia.

- Note the Valuation Date, indicating when the goods were exported from overseas.

- If you are a registered client, select 'Yes' for EFT payment; otherwise, leave this section blank.

- Clearly state the total amount indicated on all invoices for the goods in the Invoice Total field.

- Provide any amounts for transport and insurance in the respective fields, if applicable.

- Complete the Transportation details with information about how the goods were delivered, whether by air, sea, or postal service.

- Fill in Tariff Details for each type of goods, providing descriptions and necessary classifications as required.

- If you have additional information to add that may help Customs assess your declaration, include it in the Additional Information section.

- Once all fields are complete, review your form for accuracy, then save your changes, download, print, or share the completed form as necessary.

Ensure your import declaration is accurate and submit the N10 Form online.

Section 48(1) of the RTA permits the landlord to give notice of termination to a tenant if the landlord, in good faith, requires the unit for residential occupation for a period of at least one year by the landlord, a specified family member or a caregiver. This notice is often referred to as a "N12 notice".

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.