Loading

Get Iht200

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht200 online

The Iht200 form is essential for reporting the value of an estate for inheritance tax purposes. This guide offers a clear, step-by-step approach to completing the Iht200 online, ensuring users can navigate the process confidently.

Follow the steps to accurately complete your Iht200 form.

- Press the ‘Get Form’ button to access the Iht200 form and open it in the online editor.

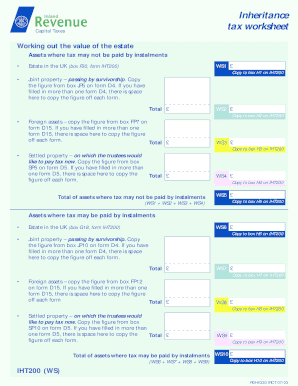

- Begin by reviewing the section regarding assets where tax may not be paid by instalments. Enter the total value of the estate in the UK corresponding to box F30 on the Iht200 in the provided field labeled WS1. Ensure to copy this figure to box H1 on the Iht200.

- Then, proceed to complete the next assets sections. For joint property passing by survivorship, copy the figure from box JP5 on form D4 into WS2 and transfer this amount to box H2 on the Iht200. Repeat this process for foreign assets and settled property, ensuring to record totals in their respective fields.

- Next, calculate the total of the assets where tax may be paid by instalments. Total the amounts in WS6, WS7, WS8, and WS9, and copy this figure to WS10 before transferring it to box H10 on the Iht200.

- Continue to calculate the chargeable estate by summing the amounts from WS5, WS10, WS11, and WS12. Transfer this total to WS13, then copy it to box H13 on the Iht200.

- Determine the cumulative total of lifetime transfers by recording the values from box LT1 on form D3 in WS14 and transferring the resulting total to box H14 on the Iht200.

- For tax calculations, copy the aggregate chargeable transfer value from WS15 to box H15, then follow through with additional calculations for tax due, ensuring to fill in each corresponding box accurately.

- Finally, review your entries for accuracy. You can save your changes, download, or print the completed form as needed. Make sure you share the form with relevant parties if required.

Complete your Iht200 form online today and ensure your estate is accurately reported.

You'll need to use the print and post form (IHT205) if the person died on or after 6 April 2011, and on or before 31 December 2021, and the estate is unlikely to pay Inheritance Tax. If the person died on or before 6 April 2011 you'll need to read Inheritance Tax forms and notes for deaths before 6 April 2011.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.