Loading

Get Us Individual 2002 Notes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the US Individual 2002 Notes online

This guide is designed to help users complete the US Individual 2002 Notes form accurately and efficiently. By following the step-by-step instructions provided, individuals can ensure that all necessary information is included for successful processing.

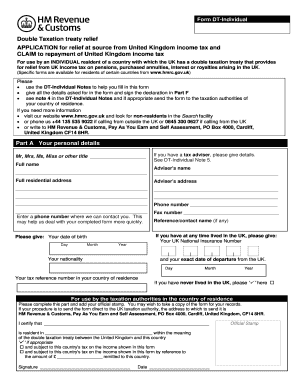

Follow the steps to complete the US Individual 2002 Notes online:

- Press the ‘Get Form’ button to access the US Individual 2002 Notes and open it in your preferred editor.

- Begin by filling out Part A with your personal details. Include your title, full name, phone number, and national insurance number if you have one.

- If applicable, provide details of your tax advisor in the designated fields, ensuring you include their name and address.

- In Part B.1, answer the residency questions accurately, selecting the appropriate options for your current tax residence.

- Detail your income sources in Part C. Indicate if you are applying for relief at source from UK income tax on pensions or other incomes.

- If you have received payments with tax deducted, complete Part D to reclaim any overpaid UK income tax.

- Complete Part E if you prefer the repayment to be issued to a nominee, providing their details.

- Finally, sign and date the declaration in Part F to confirm the accuracy of your application.

- Once all sections are completed, save your changes, and proceed to download, print, or share the completed form.

Take action now and complete your documents online for a hassle-free experience.

(1) The business profits of an enterprise of one of the Contracting States shall be taxable only in that State unless the enterprise carries on business in the other Contracting State through a permanent establishment situated therein.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.