Loading

Get C4 Corrective Account

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the C4 Corrective Account online

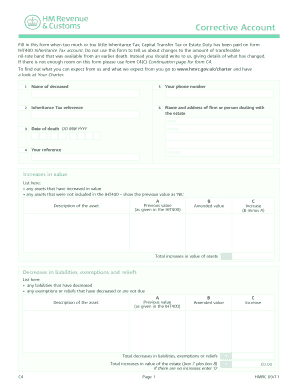

Filling out the C4 Corrective Account is essential when there has been an overpayment or underpayment of Inheritance Tax, Capital Transfer Tax, or Estate Duty based on the IHT400 form. This guide will provide you with clear and concise instructions to complete the form accurately and efficiently online.

Follow the steps to fill out the C4 Corrective Account online.

- Click ‘Get Form’ button to obtain the C4 Corrective Account form and open it in your editor.

- Enter the name of the deceased in the first field. Make sure to provide their full name as it appears in official records.

- Fill in the Inheritance Tax reference number in the next field. This reference is crucial for processing your form.

- Indicate the date of death using the format DD MM YYYY. This is important for tax calculations.

- Provide your reference number in the designated field, which helps to track your submission.

- Include your phone number for any follow-up communications related to the form.

- Input the name and address of the firm or person handling the estate in the provided fields.

- In the section for increases in value, list any assets that have increased in value or were not included in the IHT400. For each asset, provide the asset's description, the previous value, the amended value, and calculate the increase.

- In the section for decreases in liabilities, exemptions, and reliefs, list any decreases accordingly. Similar to the previous step, document the asset description, previous value, amended value, and any reductions.

- Calculate the total increases in value of the estate by summing the values from the increases and decreases sections.

- Fill in any decreases in value by describing relevant assets and providing the necessary values.

- In the increases in liabilities section, document any liabilities or exemptions that have changed, detailing previous and amended values.

- Summarize the total decreases in value of the estate.

- Enter the value of the estate as shown on the IHT400, ensuring you refer to the correct box from the previous form.

- Calculate the current value of the estate by adding the previous total with any recent inputs minus the original estate value.

- If filling out the form independently and without professional assistance, leave the tax boxes blank.

- Finally, complete the declaration section by signing and dating the form. Ensure that all representatives involved provide their signatures where required.

- Once everything is filled out, save your changes, then download, print, or share the form as needed.

Take action now and complete your C4 Corrective Account online.

Details. Use form C4 to send in a correction when too much or too little Inheritance Tax has been paid on form IHT400 - if you also need an additional Grant of Confirmation for assets in Scotland use form C4(S) instead. Email HMRC to ask for this form in Welsh (Cymraeg).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.