Loading

Get P161w Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P161w Form online

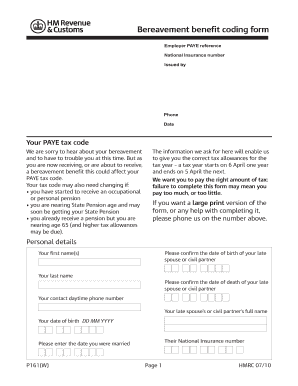

Completing the P161w Form online is essential for ensuring that your bereavement benefits and tax allowances are processed correctly. This guide will provide clear and detailed instructions to help you navigate the form with ease.

Follow the steps to complete the P161w Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal details in the provided fields, including your first name(s), last name, date of birth, and contact daytime phone number. Ensure that the information is accurate as it will be used for your bereavement allowances.

- Next, confirm the details of your late spouse or civil partner, including their full name, date of birth, National Insurance number, and date of death. This information is crucial for validating your claim.

- Indicate which benefits you receive, such as the State Pension, Widowed Parent’s Allowance, or Bereavement Allowance, and provide the weekly amounts. If applicable, include the start date for these benefits.

- If you have additional pensions, fill in the information regarding your first and second pensions, including the name and address of the pension provider, type of pension, and the monthly amount before tax.

- Detail any other taxable income, including Jobseeker’s Allowance, taxed incapacity benefit, or employment and support allowance. Include the current weekly benefit amount and any relevant dates.

- In the section for savings income, enter your estimated taxed bank or building society interest, company dividends, and any other taxable income. Ensure to include only your share for joint accounts.

- In the 'Other information' section, provide any additional details about expected changes in your income and include any charitable giving information if applicable.

- Finally, sign and date the form. Check all entries before sending it to ensure accuracy and completeness.

Complete your P161w Form online today to ensure you receive your correct tax allowances.

Some income is tax-free. The current tax year is from 6 April 2022 to 5 April 2023....Income Tax rates and bands. BandTaxable incomeTax ratePersonal AllowanceUp to £12,5700%Basic rate£12,571 to £50,27020%Higher rate£50,271 to £150,00040%Additional rateover £150,00045%

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.