Loading

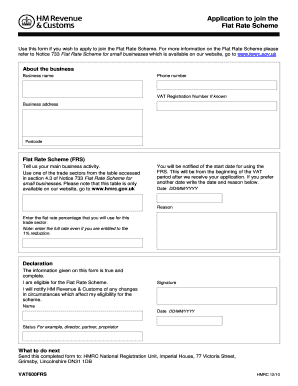

Get Application To Join The Flat Rate Scheme - Hm Revenue & Customs - Hmrc Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application To Join The Flat Rate Scheme - HM Revenue & Customs online

This guide provides a clear and supportive overview of how to complete the Application To Join The Flat Rate Scheme from HM Revenue & Customs. By following these steps, you will ensure that your application is accurately filled out and submitted correctly.

Follow the steps to successfully complete your application.

- Press the ‘Get Form’ button to access the application form and open it for editing.

- Provide general business information. Fill in your business name, phone number, VAT registration number if known, business address, and postcode in the designated fields.

- Indicate your main business activity by selecting from one of the trade sectors listed in the table available in section 4.3 of Notice 733. This table can be found on the HMRC website.

- Specify your preferred start date for using the Flat Rate Scheme. If you would like a different date than the default VAT period start date, enter this date in the format DD/MM/YYYY and provide a reason.

- Enter the flat rate percentage that applies to your trade sector. Make sure to input the full rate, even if you qualify for a 1% reduction.

- Review the declaration carefully. Confirm that the information is accurate, that you are eligible for the Flat Rate Scheme, and that you will notify HM Revenue & Customs of any relevant changes.

- Sign the form in the designated area. Include your name, the date in the format DD/MM/YYYY, and your status (e.g., director, partner, or proprietor).

- Once completed, save your changes, and download or print the form. Send the completed form to: HMRC National Registration Unit, Imperial House, 77 Victoria Street, Grimsby, Lincolnshire DN31 1DB using the proper address format.

Complete your application online today to join the Flat Rate Scheme.

You can apply at the time you register your business for VAT, or any time later. If you apply near the time of your VAT registration, you can start using the scheme from the date you are registered for VAT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.