Loading

Get Vat1 Application For Registration - Hmrc Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VAT1 Application For Registration - Hmrc Gov online

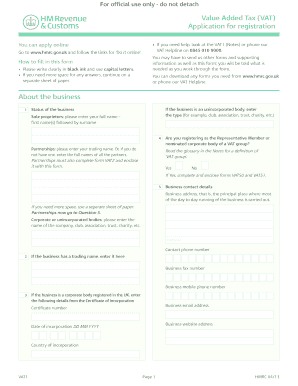

Completing the VAT1 Application For Registration is essential for businesses seeking to register for Value Added Tax. This guide offers clear, step-by-step instructions to help users easily fill out the form online, ensuring compliance and accuracy in the registration process.

Follow the steps to successfully complete the VAT1 application form.

- Click the 'Get Form' button to obtain the VAT1 application form and open it in your editor.

- Begin with your business information. Specify whether your business is an unincorporated body and provide the type, such as a club or charity. Sole proprietors should enter their full name, while partnerships must include their trading name or the full names of all partners.

- Indicate whether you are registering as the Representative Member or nominated corporate body of a VAT group. Select 'Yes' or 'No' and complete the necessary additional forms if applicable.

- Enter your business contact details, including the principal business address, trading name (if any), and a valid postcode. Include contact numbers such as phone, fax, mobile, and email address, ensuring clarity and accuracy.

- Describe your business activities. Provide information regarding your main activities and, if applicable, specify if they are related to land or property.

- If you are taking over a going concern, fill in details of the previous business, including names, VAT numbers, and the effective date of registration.

- Answer questions related to voluntary registration, exemption from registration, and any relevant details about the expected turnover. Ensure to provide accurate estimation values.

- Complete the applicant details section. Provide your name, home address, date of birth, and sign the declaration to confirm the information is true and complete.

- Review your completed form. Double-check all entries for accuracy and completeness before saving changes, downloading, and printing the document for submission.

Start your VAT registration process online by filling out the VAT1 Application For Registration now.

How to register for VAT on eFiling Create or logon to your eFiling profile. Navigate to SARS Registered Details functionality: ... Select Maintain SARS Registered Details on the left menu. The Maintain SARS Registered Details screen will display. ... Select VAT under My tax products > Revenue on the left menu.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.