Loading

Get T5007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T5007 online

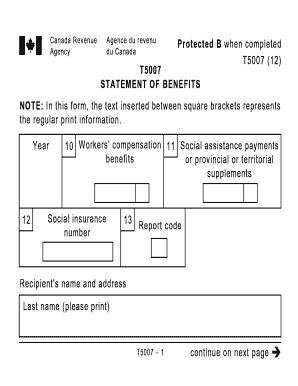

The T5007 form, or Statement of Benefits, is an essential document used for reporting benefits received from workers' compensation and social assistance. This guide provides clear, step-by-step instructions to assist users in successfully completing the T5007 online.

Follow the steps to accurately complete the T5007 online.

- Press the ‘Get Form’ button to obtain the form and open it in your chosen digital format.

- Begin by filling out the recipient's information, including the last name, first name, initials, address, city, province or territory, and postal code.

- Next, enter the payer's information by providing their name, address, city, province or territory, and postal code.

- In Box 10, indicate the total workers' compensation benefits received, as this amount will need to be reported on your income tax and benefit return.

- In Box 11, input the total social assistance payments or provincial supplements received, ensuring to follow any instructions regarding reporting based on household income.

- Review the form for accuracy and completeness, ensuring all necessary fields are filled out.

- Once all information is verified, you can save your changes, download the document, or print it as needed for your records.

Complete your T5007 online today for a seamless filing experience.

Use T5007 slips to identify recipients of workers' compensation benefits and social assistance payments, and to report the amount of benefits and assistance paid to them. There are three individual T5007 slips on each page. These can be downloaded and printed and the information can be typed or filled out by hand.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.