Loading

Get Schedule 548 Corporations Information Act Annual ... - Cra-arc Gc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SCHEDULE 548 CORPORATIONS INFORMATION ACT ANNUAL RETURN online

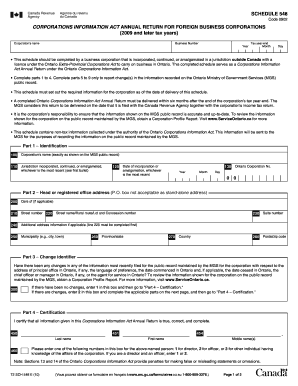

Filling out the SCHEDULE 548 CORPORATIONS INFORMATION ACT ANNUAL RETURN is an essential task for foreign business corporations operating in Ontario. This guide will provide clear, step-by-step instructions to ensure that you accurately complete this form online.

Follow the steps to successfully complete your annual return.

- Click ‘Get Form’ button to obtain the document and open it in your editor.

- In Part 1, enter the corporation's name exactly as it appears on the Ontario Ministry of Government Services public record. Fill in the jurisdiction where the corporation was incorporated, along with the date of incorporation or amalgamation.

- In Part 2, provide the complete head or registered office address. Ensure that you include all necessary details such as the street number, street name, municipality, province, country, and postal code. Note that a P.O. box is not acceptable as the stand-alone address.

- Move to Part 3 to identify if there have been any changes in the information filed with the public record. Enter '1' if there are no changes and proceed to Part 4, or '2' if there are changes and continue filling out the relevant parts.

- In Part 4, certify the accuracy of your information by entering the name of the person certifying the document and their designation (director, officer, or other knowledgeable individual).

- If applicable, complete Parts 5 through 9 to report changes in the principal office address, language preference, dates of activity, chief officer or manager details, and the agent for service.

- Review all entered information for accuracy. Make necessary amendments if required.

- Once finished, you can save changes, download, print, or share the form according to your needs.

Ensure compliance and file your document online today!

The Corporations Information Act Annual Return For Ontario Corporations (“Ontario Annual Return”) is an annual information return disclosing basic information about an Ontario corporation, including the corporation's name, business address, and directors and officers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.