Loading

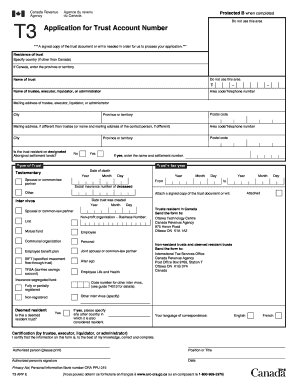

Get T3 Application For Trust Account Number

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T3 Application For Trust Account Number online

Filling out the T3 Application For Trust Account Number online is an important step in establishing a trust's tax identification. This guide is designed to provide clear and detailed instructions for each section of the application, ensuring you can complete it correctly and efficiently.

Follow the steps to successfully complete the form

- Press the ‘Get Form’ button to access the T3 Application for Trust Account Number and open it in your online editor.

- Begin by entering the residence of the trust. Indicate the country if it is not Canada, or select the appropriate province or territory if it is.

- Provide the name of the trust. Ensure this name matches the legal documentation associated with the trust.

- Enter the name of the trustee, executor, liquidator, or administrator responsible for the trust's administration.

- Fill in the area code and telephone number of the trustee, executor, liquidator, or administrator to facilitate communication.

- Complete the mailing address for the trustee, executor, liquidator, or administrator, including city, postal code, and province or territory.

- If the mailing address is different from that of the trustee, provide the alternate mailing address, including contact details.

- Specify whether the trust is located on designated Aboriginal settlement lands. If yes, provide the name and settlement number.

- Select the type of trust being established, such as testamentary or spousal/common-law partner.

- Enter the trust's tax year, date of death if applicable, and the date the trust was created, noting the year, month, and day.

- Indicate if it is a non-profit organization and provide the business number if applicable.

- Complete any additional information related to the trust's tax filing status or its resident status in other countries, if relevant.

- Select your preferred language of correspondence for future communications regarding this application.

- In the certification section, ensure the trustee, executor, liquidator, or administrator certifies the information by providing their printed name, title, signature, and date of certification.

- Once all sections are completed and verified for accuracy, save the changes and proceed to download, print, or share the form as necessary.

Complete your T3 Application For Trust Account Number online today to ensure timely processing of your trust's tax identification.

A T3 tells you how much income you received from investment in mutual funds in non-registered accounts, from business income trusts or income from an estate for a given tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.