Loading

Get Gst498 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst498 form online

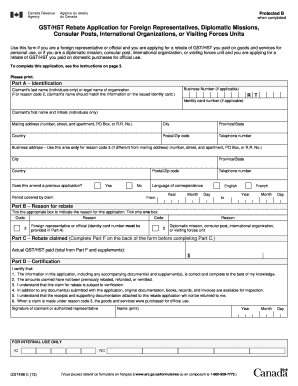

This guide provides a comprehensive overview of how to complete the Gst498 form online. Designed for foreign representatives, diplomatic missions, and international organizations, it outlines the necessary steps to effectively fill out the form and submit your application for a GST/HST rebate.

Follow the steps to fill out the Gst498 form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part A, enter your identification details, including your last name or legal name of your organization, Business Number (if applicable), and mailing address. Be sure to indicate if this application amends a previous one.

- For Part B, select the appropriate reason for claiming the rebate by ticking the suitable box. Remember, only one box can be selected.

- In Part C, provide the total actual GST/HST paid based on the calculations you have made in Part F, which must be completed prior to this section.

- In Part D, confirm the correctness of the information provided and sign the form either as the claimant or as an authorized representative.

- If applicable, fill out Part E with a third-party address if someone is filing the application on your behalf as per the guidelines provided.

- Complete Part F by detailing all the necessary information regarding the purchases made, including quantities, descriptions, and the tax amounts paid. Ensure to attach any required receipts.

- Review your completed form for accuracy and completeness. Once verified, you can save changes, download, print, or share the form as necessary.

Complete your Gst498 form online today to ensure a smooth rebate application process.

Exempted Goods and Services Foreign purchasers of Canadian products do not have to pay the HST provided that the goods or services will be solely used outside of the country. However, nonresidents visiting Canada, such as tourists, are required to pay the HST. In some cases, they may qualify for an HST rebate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.