Loading

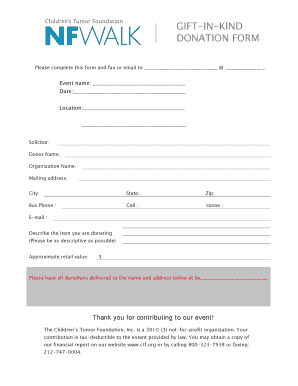

Get Gift-in-kind Donation Form - Children's Tumor Foundation - Ctf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GIFT-IN-KIND DONATION FORM - Children's Tumor Foundation online

This guide provides clear and supportive instructions to help you complete the GIFT-IN-KIND DONATION FORM for the Children's Tumor Foundation. Whether you are familiar with donation forms or not, this step-by-step guide will assist you in accurately filling out the necessary information.

Follow the steps to complete the donation form.

- To obtain the form, press the ‘Get Form’ button to access it in an editable format.

- Begin by filling in the event name in the designated field. This is where you identify the specific event for which the donation is being made.

- Next, provide the date of the event. This information helps ensure that your donation aligns with the event timeline.

- Fill out the location of the event, including all relevant details such as the venue or address.

- In the Solicitor section, enter the name of the person or organization handling the donation.

- Supply your donor name, which could be an individual or an organization contributing the donation.

- Complete the organization name field if applicable. This is especially important for corporate donations.

- Provide your mailing address, ensuring it is complete with city, state, and zip code to facilitate communication.

- Fill in the business phone, cell phone, and home phone fields as necessary. This allows the Foundation to contact you if needed.

- Enter your email address to receive any correspondence related to your donation.

- Describe the item you are donating in detail. Be as descriptive as possible to provide clarity on the donation's nature.

- Indicate the approximate retail value of your donation in the specified field. This information is important for tax purposes.

- Specify the name and address where the donations should be delivered, along with the deadline for delivery.

- After filling out all sections of the form, review the information for accuracy and completeness.

- Once you are satisfied with the form, save your changes and then download, print, or share the form according to your preference.

Complete your gift-in-kind donation form online today and contribute to a meaningful cause!

The IRS considers in-kind donations to be a contribution, and the value of the donation is generally considered as its market value. The IRS allows you to deduct the fair market value of property donated. Only donations to registered 501(c)(3) nonprofits are eligible for a deduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.