Loading

Get Sacu Overdraft Protection Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sacu Overdraft Protection Form online

This guide will assist you in accurately completing the Sacu Overdraft Protection Form online. By following these step-by-step instructions, you can ensure that you provide the necessary information for overdraft protection with ease.

Follow the steps to fill out the Sacu Overdraft Protection Form online.

- Press the ‘Get Form’ button to access the Sacu Overdraft Protection Form and open it in your preferred PDF editor.

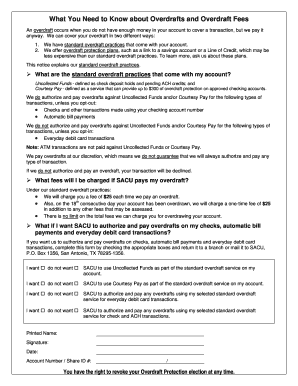

- Review the form's sections carefully. You will see options that allow you to indicate your preferences regarding Uncollected Funds and Courtesy Pay.

- In the designated fields, check the boxes indicating whether you want or do not want SACU to use Uncollected Funds as part of your overdraft services.

- Similarly, indicate whether you want or do not want SACU to utilize Courtesy Pay for your account.

- Next, specify your preference for overdraft coverage on everyday debit card transactions by checking the appropriate box.

- Lastly, indicate your choice regarding overdrafts for checks and ACH transactions in the corresponding section.

- Provide your printed name, signature, and the date at the bottom of the form.

- Enter your account number or share ID in the specified field.

- Once you have completed the form, save your changes, download a copy, or print the form for your records. You may also share it as needed.

Complete your Sacu Overdraft Protection Form online today to ensure your banking needs are met.

Can I get my bank to waive overdraft fees? Some banks may refund an overdraft fee after you contact customer service and explain your situation, especially if you've been a loyal customer and rarely overdraw your account. Other banks might have a formal program that either waives or helps you avoid overdraft fees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.