Loading

Get E-scholarship Form 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E-SCHOLARSHIP FORM 2010 online

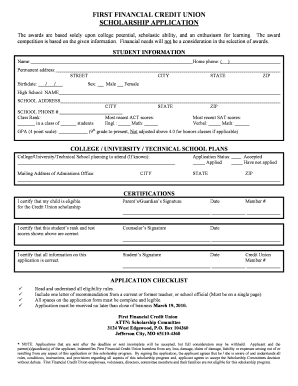

The E-SCHOLARSHIP FORM 2010 is a vital document for students seeking scholarship opportunities. This guide will provide you with a detailed, step-by-step approach to completing the form online, ensuring you submit a thorough and accurate application.

Follow the steps to successfully complete the E-SCHOLARSHIP FORM 2010 online.

- Click 'Get Form' button to obtain the form and open it in your preferred editor.

- Begin filling in the 'Student Information' section. Enter your name, home phone number, permanent address, and birthdate. Choose your sex from the options provided (male or female).

- Provide information about your high school. Include the school's name, address, and phone number. Enter your class rank and mention the size of your graduating class.

- Fill out the section for most recent standardized test scores, including ACT and SAT scores where applicable. Input your GPA on a 4.0 scale.

- In the 'College / University / Technical School Plans' section, specify the institution you plan to attend, if known. Indicate your application status by marking the appropriate option.

- Complete the 'Certifications' section by obtaining the necessary signatures. Include your signature, your parent’s or guardian’s signature, and your counselor's signature along with the respective dates.

- Ensure you have followed the application checklist, including reading eligibility rules, submitting a letter of recommendation, and completing all required fields.

- Once you have filled out the form, review all entries for accuracy. Make sure the document is complete and legible.

- Save your changes to the form. Download, print, or share the document as needed, and prepare it for submission to the designated address.

Complete your E-SCHOLARSHIP FORM 2010 online today and take the first step toward your scholarship application!

Related links form

Generally, you report any portion of a scholarship, a fellowship grant, or other grant that you must include in gross income as follows: If filing Form 1040 or Form 1040-SR, include the taxable portion in the total amount reported on Line 1a of your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.