Loading

Get Msufcu Business Loan Application - Msu Federal Credit Union - Msufcu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MSUFCU Business Loan Application - MSU Federal Credit Union - Msufcu online

Filling out the MSUFCU Business Loan Application can seem daunting, but with careful attention to each section, you can navigate it successfully. This guide provides a step-by-step approach to assist you in completing the application online.

Follow the steps to effectively complete your application:

- Press the ‘Get Form’ button to access the application document in an editable format.

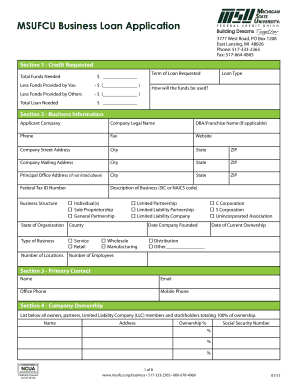

- Begin with Section 1 where you will provide details about the credit requested. Fill in the total funds needed, any funds you will contribute, and any funds provided by others. Make sure to clearly indicate the total loan needed and term of the loan requested.

- Move to Section 2 to provide your business information. Include the company legal name, DBA or franchise name if applicable, contact details, physical addresses, federal tax ID number, business structure, and descriptive categories.

- Proceed to Section 3, where you will identify the primary contact person for the application. Include their name, email, and phone numbers.

- In Section 4, list all owners and stakeholders of the business along with their addresses, ownership percentages, and social security numbers. Ensure that the total ownership percentages add up to 100%.

- Section 5 requires you to list any affiliates or business concerns where ownership or controlling interest exists. Provide the necessary details about each affiliated company.

- In Section 6, compile a schedule of any business debt. For each debt, specify the original amount, current balance, monthly payment, lender details, and collateral if applicable.

- Section 7 asks for details about any collateral you are offering for the loan. List descriptions, values, and ownership statuses for each collateral item.

- Section 8 is about any unsettled lawsuits, judgments, or disputes. Answer the question and provide explanations if necessary.

- List authorized signers for the application in Section 9. Input names, titles, dates of birth, social security numbers, and addresses.

- In Section 10, identify your professional services such as your accounting firm, legal counsel, and insurance agency, along with relevant contact persons.

- Finally, review the applicant signatures section. Ensure that all signatures are provided along with printed names and dates.

- Once everything is completed, save any changes you made. You can opt to download, print, or share the form as required.

Complete your MSUFCU business loan application online today and take the next step toward your business goals.

Related links form

The three components of geotechnical settlement Immediate settlement (also known as elastic settlement) Consolidation settlement (or primary settlement) Creep settlement (or secondary settlement).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.