Loading

Get Savers Bank L9oan Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Savers Bank L9oan Application Form online

Filling out the Savers Bank L9oan Application Form online is a pivotal step towards securing your personal loan. This guide will walk you through each section of the form, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to complete your loan application.

- Click ‘Get Form’ button to obtain the form and open it in your selected online tool for editing.

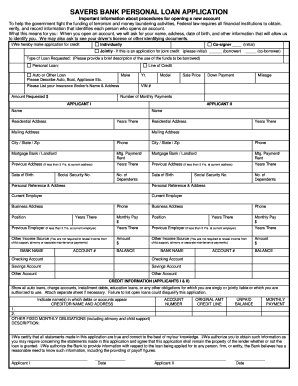

- Begin by indicating the type of loan you are requesting. Choose the relevant option such as personal loan, line of credit, or auto loan. Provide a brief description of how you plan to use the funds.

- Fill out the applicant sections for both Applicant I and Applicant II, including name, residential address, mailing address, phone number, and the details of your current and previous employment. Ensure all information is accurate.

- List your financial information, including the amount requested, any down payment, and details of your mortgage or rent payments.

- Provide information regarding any dependents and your date of birth for both applicants.

- Include your social security number, as well as the contact information for personal references.

- At the credit information section, disclose all debts and obligations by indicating the creditor name and address, account number, original amount, unpaid balance, and monthly payment.

- Review all entered information for accuracy and completeness. Make necessary corrections if needed.

- Lastly, certify the accuracy of your statements by signing and dating the application. Once everything is in order, you can save your changes, download, print, or share the completed form.

Start completing your Savers Bank L9oan Application Form online today to take the next step toward your financial goals.

Getting a personal loan can be a relatively simple process, but to qualify, lenders usually require information about your credit history, income, employment status and current debt obligations. Your income needs to be high enough to cover the loan repayment amount and your other monthly expenses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.