Loading

Get Customer Identification Verification Form - Mb Financial Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Customer Identification Verification Form - MB Financial Bank online

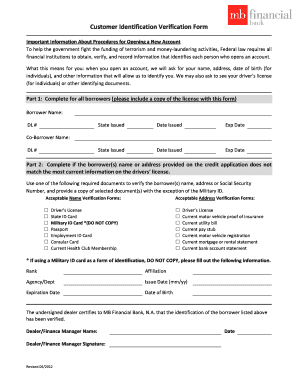

Filling out the Customer Identification Verification Form is an essential step in opening an account with MB Financial Bank. This guide will help you understand each section of the form and provide you with clear instructions to complete it online efficiently.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by completing Part 1, which is required for all borrowers. Enter the borrower’s name, driver’s license number (DL #), state issued, date issued, and expiration date. If there is a co-borrower, provide the same details for them.

- Proceed to Part 2 if the borrower’s name or address does not match the current information on their driver’s license. You must provide a copy of one of the acceptable documents to verify the borrower’s name, address, or Social Security Number.

- Select and check one box from the acceptable address verification forms and one from the acceptable name verification forms to indicate which document(s) you are providing.

- If using a Military ID card, fill in the required information including rank, affiliation, agency/department, issue date, expiration date, and date of birth, and ensure to not provide a copy of the military ID.

- Finally, the dealer or finance manager needs to certify that the identification of the borrower has been verified. They should fill in their name, provide a signature, and date the form.

- Once all fields have been completed accurately, save changes to the form. You can then download, print, or share the document as needed.

Take the next step in your account opening process and complete your Customer Identification Verification Form online.

KYC process includes ID card verification, face verification, document verification such as utility bills as proof of address, and biometric verification. Banks must comply with KYC regulations and anti-money laundering regulations to limit fraud. KYC compliance responsibility rests with the banks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.