Loading

Get Mortgage Loan Disclosure Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Loan Disclosure Statement online

Filling out the Mortgage Loan Disclosure Statement online is an essential part of the mortgage application process. This document provides vital information regarding the terms of your mortgage loan and the associated costs, ensuring you understand your financial obligations before purchasing a property.

Follow the steps to complete the Mortgage Loan Disclosure Statement online.

- Click ‘Get Form’ button to access the Mortgage Loan Disclosure Statement and open it in an online editor.

- Begin by entering the borrower's name(s) in the designated field at the top of the form. Ensure that all names are spelled correctly.

- Fill in the real property collateral information. Provide the street address or legal description of the property that will serve as security for the loan.

- In the section labeled 'This joint Mortgage Loan Disclosure Statement/Good Faith Estimate,' indicate the name of the mortgage broker who is providing the document. If the lender is known, provide their name; if not, select ‘Unknown’.

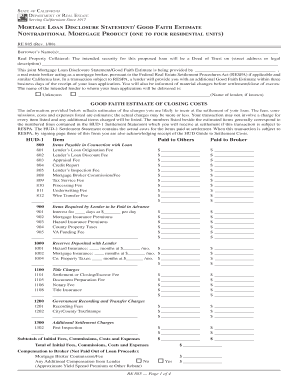

- Review the Good Faith Estimate of closing costs section, where you will detail the estimated charges likely to be incurred during loan settlement. Carefully enter values for each item, such as the lender’s loan origination fee, appraisal fee, and more, as specified in the form.

- Complete the 'items required by lender to be paid in advance' section by specifying interest for the number of days, mortgage insurance premiums, and other fees that apply.

- In the reserves deposited with the lender section, list the number of months for hazard insurance, mortgage insurance, and county property taxes, along with their corresponding amounts.

- For the title charges, provide the required amounts for escrow fees, document preparation fees, notary fees, and title insurance. Ensure to fill each field accurately.

- Fill out the government recording and transfer charges, and additional settlement charges sections as applicable.

- Complete the section titled 'additional required California disclosures' by entering the proposed loan amount, loan term, proposed interest rate, and any relevant details about payment options.

- After all sections are filled out, review the entire document for accuracy. Make any necessary corrections.

- Finally, save your changes, download the completed form, print a copy for your records, or share it with your mortgage broker.

Complete your Mortgage Loan Disclosure Statement online today to ensure a seamless mortgage process.

Related links form

The Truth in Lending Act, or TILA, also known as regulation Z, requires lenders to disclose information about all charges and fees associated with a loan. This 1968 federal law was created to promote honesty and clarity by requiring lenders to disclose terms and costs of consumer credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.