Loading

Get Consent To Disclosure Of Tax Return Information ( We ... - 1040.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Consent To Disclosure Of Tax Return Information ( We ... - 1040.com online

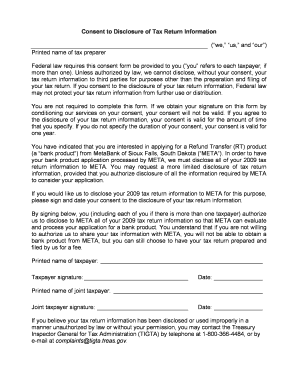

This guide provides a clear and supportive walkthrough for completing the Consent To Disclosure Of Tax Return Information. By following these steps, you can confidently fill out the form to ensure your tax return information is handled as you desire.

Follow the steps to complete the consent form efficiently.

- Click the ‘Get Form’ button to access the consent form and open it for editing. This will allow you to begin the filling process.

- Enter the printed name of the tax preparer in the designated field, ensuring that the name is spelled correctly to avoid any issues with processing.

- Review the purpose statement of the form, which explains that consent is required for your tax return information to be disclosed to third parties. Ensure that you understand the implications of signing this form.

- Indicate if you consent to the disclosure of your tax return information by checking the appropriate box or entering the date range for which this consent is valid. Remember, if no duration is specified, the consent will automatically be valid for one year.

- If you wish to apply for a Refund Transfer product from META, ensure you consent to share your 2009 tax return information. You may specify if you want a more limited disclosure if applicable.

- Sign and date the consent form in the designated areas. If applicable, enter the printed name and signature of any joint taxpayer, along with their date.

- Once you have completed the form, review all entries to confirm accuracy. After verifying that all required fields are filled out correctly, you can choose to save changes, download, print, or share the completed form.

Complete your Consent To Disclosure Of Tax Return Information online today to ensure your tax processing needs are met professionally.

7216 is a criminal provision enacted by the U.S. Congress in 1971 that prohibits preparers of tax returns from knowingly or recklessly disclosing or using tax return information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.