Loading

Get Virginia St 9 Form After July 1 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virginia St 9 Form After July 1 2013 online

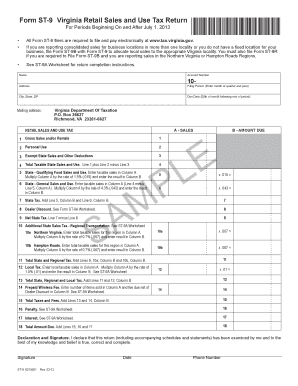

Filing the Virginia St 9 Form accurately is crucial for compliance with Virginia's sales and use tax regulations. This guide provides step-by-step instructions to help you navigate the online filling process efficiently.

Follow the steps to fill out the Virginia St 9 Form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in your name, account number, and address in the designated fields. Ensure the accuracy of this information as it is essential for identification.

- Enter the filing period in the format of month or quarter followed by the year. This is crucial to indicate the relevant tax period.

- Provide your city, state, and ZIP code in the appropriate fields to confirm your business location.

- Input the due date, which is the 20th of the month following the end of the period. This helps avoid late penalties.

- In the A - Sales section, fill out gross sales and/or rentals, personal use, and exempt state sales and other deductions as applicable.

- Calculate total taxable state sales and use by summing line 1 and line 2, then subtracting line 3.

- For qualifying food sales and use, enter the amounts in Column A and calculate the tax in Column B using the provided rate.

- Enter the general state sales and use amounts in a similar manner, ensuring accurate calculations based on taxable sales.

- Complete the B - Amount Due section by calculating the net state tax, additional state sales tax, total state and regional tax, and local tax.

- Make sure to account for any penalties or interest if applicable, and summarize the total amount due at the end of the form.

- Review the declaration and signature section, sign the form, and enter the date.

- Once you have completed and reviewed all fields, save your changes. You can then download, print, or share the form as needed.

Complete your Virginia St 9 Form online today to ensure compliance and avoid penalties.

Related links form

Complete Form 760, Lines 1 through 9, to determine your Virginia Adjusted Gross Income (VAGI). If the amount on Line 9 is less than the amount shown below for your filing status, your Virginia income tax is $0 and you are entitled to a refund of any withholding or estimated tax paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.