Loading

Get Form 505

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 505 online

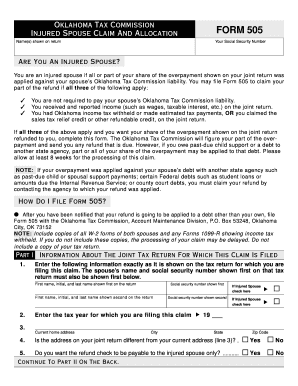

Filling out Form 505 is essential for users seeking to claim their share of a tax refund when part of it has been applied to a spouse's debt. This guide provides a step-by-step approach to help users understand and complete the form online with ease and confidence.

Follow the steps to successfully complete Form 505 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the names as they appear on your joint tax return under the section for Name(s) shown on return. Make sure to list your spouse’s name first.

- Input your Social Security Number (SSN) in the designated field.

- Indicate whether you are an injured spouse by checking the appropriate box. You qualify if three conditions are met.

- Provide the tax year for which you are filing the claim in the specified area.

- Complete your current home address in the provided fields, including the city, state, and zip code.

- If your current address differs from the address on your joint return, check 'Yes' or 'No' accordingly.

- Decide if you want the refund check payable to the injured spouse only and check 'Yes' or 'No'.

- Proceed to Part II, where you will allocate income and deductions. For each item listed, enter amounts in the appropriate columns for both spouses.

- Continue filling out allocation fields (from lines 6 to 12), ensuring each amount is entered based on the income distribution.

- In Part III, sign the form under penalties of perjury, confirming that the information provided is correct. Include your phone number if desired.

- After completing the form, save your changes, and consider downloading, printing, or sharing as necessary.

Start completing your Form 505 online today for an efficient filing experience.

Purpose of Form Maryland law provides for an extension of time to file the pass-through entity income tax return (Form 510) or the electing pass-through entity income tax return (Form 511), but not to pay the tax due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.