Loading

Get Form Sa&i 2643 - The Oklahoma State Auditor And Inspectors ... - Sai Ok

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FORM SA&I 2643 - The Oklahoma State Auditor And Inspectors online

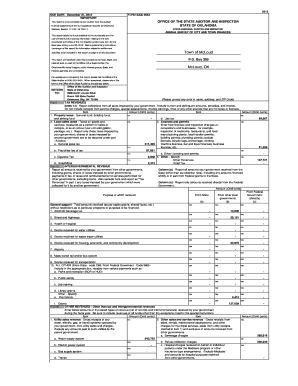

Filling out the FORM SA&I 2643 is an essential process for municipalities to report their annual finances correctly. This guide offers clear and concise steps to help users complete the form online effectively.

Follow the steps to fill out the FORM SA&I 2643 with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the municipal information at the top of the form, including the name, address, and fiscal year-end date.

- Complete the Tax Revenues section by reporting collections from all taxes imposed by your government. Ensure to include both current and delinquent amounts.

- Proceed to the Intergovernmental Revenue section. Report all amounts received from other governments, including grants and reimbursements.

- Enter Other Revenues in Part IB. This includes revenues not classified as tax or intergovernmental revenues, making sure to specify the types.

- Document Direct Expenditures by Purpose and Type in Part II. Enter gross amounts for salaries, wages, and the purpose of expenses incurred.

- In Part III, list all intergovernmental expenditures and ensure you detail payments made to other governments for various services.

- Review the Auditor Information section. Ensure that an accompanying accountant's compilation report is attached.

- Once all sections are complete, save changes, download, print, or share the form as necessary.

Complete your FORM SA&I 2643 online today for accurate municipal financial reporting.

Who Can File Form 1099-SA? Form 1099-SA is filed by providers of HSAs or MSAs, including Archer and Medicare MSAs. These forms are sent to individual account holders and the IRS. Like other 1099 forms, the issuing entity should send it to the taxpayer by the end of January each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.