Loading

Get Claim Your Share Of More Than $4 Million; The List Publishes Nov. 28 - L ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Claim Your Share Of More Than $4 Million; The List Publishes Nov. 28 - L ... online

Completing the Claim Your Share Of More Than $4 Million form online can be a straightforward process with the right guidance. This guide provides a step-by-step approach to help users fill out the form accurately and efficiently.

Follow the steps to complete the form online.

- Click the ‘Get Form’ button to access the form. This will open the document in your selected viewer or editor.

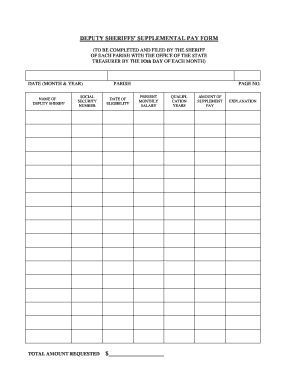

- Fill in the 'Date (Month & Year)' field with the appropriate date when you are submitted the claim.

- Enter the 'Name of Deputy Sheriff' who is filing the claim. Ensure that the name is spelled correctly for proper identification.

- Provide the 'Social Security Number' in the corresponding field. This is crucial for verifying eligibility.

- In the 'Total Amount Requested' section, input the total amount you are seeking from the claim.

- Specify the 'Parish' you are filing under. This helps designate the correct jurisdiction.

- Indicate the 'Date of Eligibility' which refers to when the deputy sheriff became eligible for supplemental pay.

- Fill in the 'Present Monthly Salary' amount, which is required for determining the supplemental pay amount.

- List any 'Qualification Years' that apply. This information may be necessary for the assessment of the claim.

- Input the 'Amount of Supplement Pay' that you are requesting in the specified field.

- Provide an 'Explanation' if necessary, detailing any additional information regarding the claim.

- Finally, review your entries for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as needed.

Begin your application by filling out the form online today.

How to Fill Out Schedule E of Your Form 1040? Enter your name and Social Security number at the top of Schedule E. In column A, enter the type of property you rented out or received royalties from. ... In column B, enter the street address of the property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.