Loading

Get Dte 101

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dte 101 online

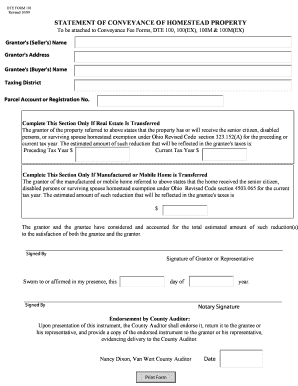

Filling out the Dte 101 form is an essential step in conveying homestead property efficiently. This guide will walk you through each section and field of the form, ensuring you complete it accurately and confidently.

Follow the steps to fill out the Dte 101 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the grantor's (seller's) name in the designated field. This should be the full legal name of the individual or entity selling the property.

- Next, fill in the grantor's address. Ensure that the address is complete and accurate, as it will be used for future correspondences.

- Enter the grantee's (buyer's) name in the corresponding field. Similar to the grantor, this should reflect the complete legal name of the purchaser.

- Specify the taxing district for the property. This information is critical for tax-related purposes and should be verified with local records if necessary.

- Provide the parcel account or registration number associated with the property. This number helps in identifying the specific property within public records.

- Complete the section regarding any homestead exemption benefits. If the property has previously received the senior citizen, disabled persons, or surviving spouse homestead exemption, indicate the estimated amount for both the preceding and current tax year.

- If you are transferring a manufactured or mobile home, fill out the relevant exemption information in this section, including the estimated amount of reduction that will affect the grantee's taxes.

- Sign the form in the space designated for the grantor or their representative. Ensure that the signature matches the name provided earlier in the form.

- A notary must witness the signing of the document. Fill in the date and name of the notary public who will affirm the signature.

- After completing the form, review all entries for accuracy. You can then save your changes, download a copy, print the form, or share it as required.

Complete your documents online today for a smoother processing experience.

The real property conveyance fee for Medina County is $3.00 per $1,000 of the sale price. (For a sale ending in a fraction of $100, the sale price is rounded up to the nearest $100.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.