Loading

Get Wisconsin Deferred Compensation Program 98971 01 Fillable Format

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wisconsin Deferred Compensation Program 98971 01 Fillable Format online

This guide provides users with step-by-step instructions on completing the Wisconsin Deferred Compensation Program 98971 01 Fillable Format online. Following these clear directions will ensure that you fill out the form accurately and efficiently.

Follow the steps to complete your form.

- Click ‘Get Form’ button to access the Wisconsin Deferred Compensation Program 98971 01 Fillable Format and open it in the editor.

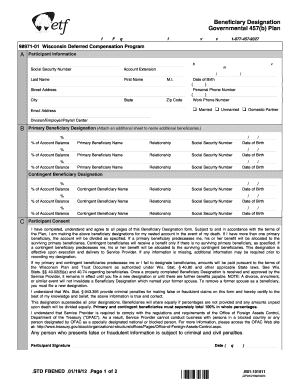

- Begin by entering your participant information in section A. Fill in your Social Security number, account extension, last name, first name, middle initial, state, zip code, street address, city, date of birth, personal phone number, work phone number, and email address. Indicate your marital status by checking the appropriate box (married, unmarried, or domestic partner).

- In section B, specify your primary beneficiary designation. You can attach an additional sheet if you wish to name more than three beneficiaries. For each beneficiary, enter their name, relationship to you, Social Security number, and date of birth, along with the percentage of the account balance they will receive.

- After filling out the primary beneficiaries, move on to the contingent beneficiary designation. Again, provide the requested details for up to three contingent beneficiaries, including their name, relationship, Social Security number, date of birth, and the percentage of the account balance they will receive.

- Review the participant consent section carefully. You must acknowledge that you have completed the form accurately and agree to its terms. Sign and date the form to finalize your designations.

- Once you have filled in all required fields and reviewed the form for accuracy, you can save your changes. You may also choose to download, print, or share the form as needed.

Complete your form online today to ensure your beneficiary designations are recorded accurately.

Maximum Deferral — Section 457 plan participants may contribute 100% of taxable income to their accounts, up to a federal maximum that is adjusted annually. In 2021, this maximum was $19,500. Note: This amount was raised to $20,500 for 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.