Loading

Get Dte Form 1 - Trumbull County Auditor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DTE Form 1 - Trumbull County Auditor online

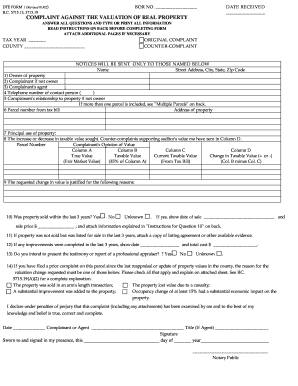

Filling out the DTE Form 1 is essential for users who wish to challenge the valuation of their real property in Trumbull County. This guide will provide clear and step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to fill out the DTE Form 1 effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date the form is received at the top of the document, marking it as your official filing date.

- Indicate the tax year for which the complaint is being filed. Ensure this matches the date of the tax year relevant to your valuation dispute.

- Specify if this is an original complaint or a counter-complaint according to the purpose of your filing.

- Fill in the name of the property owner, street address, city, state, and zip code. If the complainant is someone other than the owner, include their information in the designated sections.

- Provide a contact telephone number for the person responsible for the complaint, ensuring all parties can be reached easily during the process.

- Identify the principal use of the property. Describe accurately to support your valuation complaint.

- List the current taxable value as stated on your tax bill and your opinion of the correct value. Fill in the change in taxable value you are seeking.

- In the justification section, explain your reasoning for the value change request. Be clear and specific.

- If applicable, indicate whether the property has been sold within the last three years. If yes, provide the date of sale and sale price. Attach any supporting documents as needed.

- If the property was listed for sale during the last three years, attach evidence such as the listing agreement.

- Document any improvements made to the property in the last three years, including the date and total cost of those improvements.

- Indicate whether you plan to present the testimony or report of a professional appraiser, and check 'Yes', 'No', or 'Unknown' as applicable.

- If you filed a prior complaint on this property since the last reappraisal, specify the reasons for the valuation change and provide explanations on an attached sheet.

- Finally, include your signature, date the form, and if applicable, include the title of your role if you are filing as an agent.

- Once the form is complete, save your changes, then download, print, or share the form as needed for submission.

Submit your completed DTE Form 1 online to ensure your voice is heard in the valuation process.

The County Auditor establishes the real property value and calculates the property tax for every parcel of real estate within your county. After the taxes have been collected by the County Treasurer, the Auditor then calculates how much of the money collected goes to each taxing district.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.