Loading

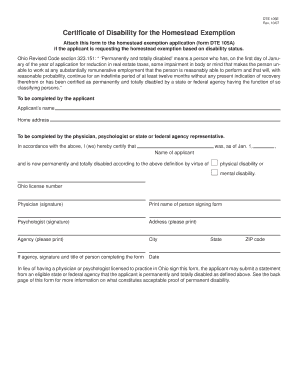

Get Form Dte 105e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Dte 105e online

This guide provides clear instructions on how to complete Form Dte 105e online, which is essential for individuals applying for a homestead exemption based on disability status. By following these steps, users can efficiently fill out the form and submit it as part of their application.

Follow the steps to complete the Form Dte 105e online.

- Press the ‘Get Form’ button to access the form and open it in the designated editing format.

- Enter the applicant’s name in the appropriate field. Ensure that the name is spelled correctly to avoid any issues during processing.

- Provide the applicant’s home address, including the street address, city, state, and ZIP code to ensure accurate identification.

- The next section must be completed by a physician, psychologist, or representative from a state or federal agency. They should certify the applicant's disability status according to the stated definitions.

- In the designated field, the certifying individual should indicate the name of the applicant and confirm the disability status as of January 1 of the application year.

- Select whether the disability is a physical or mental disability by checking the appropriate box.

- The certifying individual must provide their Ohio license number and sign the form to validate the certification.

- The individual signing the form should print their name and address for clarity.

- If an agency is completing the form, the agency’s name, city, and state must be included, along with the signature and title of the person completing the form.

- Finally, review the completed form to ensure all information is accurate, and save the document. Users can then choose to download, print, or share the completed Form Dte 105e as needed.

Complete your Form Dte 105e online today to ensure your homestead exemption application is processed without delay.

The tax exemption is limited to the homestead, which Ohio law defines as an owner's dwelling and up to one acre of land. The value of the exemption may not exceed the value of the homestead. The 2021 income threshold is $34,200, and the 2022 threshold is $34,600.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.