Loading

Get Business Return Of Tangible Personal Property - Hanover County ... - Co Hanover Va

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Return Of Tangible Personal Property - Hanover County online

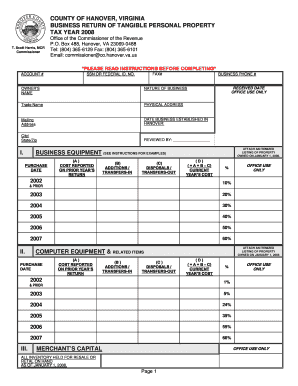

Filling out the Business Return of Tangible Personal Property for Hanover County is essential for businesses operating within the area. This guide provides clear and step-by-step instructions to assist users in completing the form online accurately and efficiently.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the Business Return of Tangible Personal Property form. This will allow you to open the document and begin filling it out in the designated online editor.

- Begin with entering your account number and your social security number or federal identification number in the respective fields. Ensure that accuracy is prioritized here as it is crucial for identifying your business records.

- Fill in the business owner's name and the nature of the business. Describe your business type succinctly, as this helps the authorities categorize your business accurately.

- Provide the physical and mailing addresses of your business. You must include the complete city, state, and zip code.

- Indicate the date your business was established in Hanover County. This helps in aligning your filing timelines and business records.

- Attach an itemized listing of all tangible personal property owned as of January 1, including costs, additions, and disposals, as outlined in the sections provided.

- Complete the sections for business equipment and computer equipment by entering the original costs and any relevant transactions, such as additions or disposals, per item for the current tax year.

- Report the merchant's capital and ensure the reported value aligns with your most recent U.S. Federal Income Tax Return. This includes inventory and equipment held for sale.

- If applicable, provide details of all leased or rented equipment, including name of the lessor, description of the property, and lease details. Ensure all entries are clear and concise.

- In the taxpayer signature section, an authorized officer must sign and date the return. Provide contact details for further queries regarding your submission.

- Review your completed form meticulously to ensure all sections are filled and accurate. Save your changes in the online editor, then proceed to download, print, or share the form as needed.

Begin your online filing process today to ensure timely submission of your Business Return of Tangible Personal Property.

Property, other than real property, whose value is derived from its physical existence. Tangible personal property includes, but is not limited to, artwork, antiques, automobiles, books, maps, archival material, technology hardware, furnishings, appliances, office and other equipment and personal items.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.