Loading

Get 499 R 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 499 R 3 online

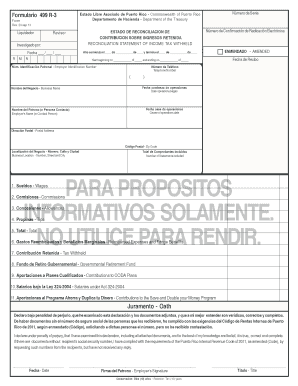

The 499 R 3 form is an important document for reconciling income tax withheld in Puerto Rico. This guide provides clear, step-by-step instructions on how to accurately fill out the form online, ensuring compliance and completeness.

Follow the steps to successfully complete the 499 R 3 online

- Use the ‘Get Form’ button to download the 499 R 3 form. This will allow you to access the necessary fields and begin your completion of the document.

- Start by entering the employer identification number in the designated field. This is critical for the proper processing of the form.

- Fill in the business name, including the postal address and contact information. Ensure to provide accurate details to avoid delays.

- Indicate both the start and end dates for the tax year being reconciled. Use clear and accurate dates to avoid complications.

- Complete the section that outlines the total number of statements included. This helps in ensuring that all documentation is accounted for.

- Provide detailed figures for wages, commissions, allowances, tips, and total amounts. This is crucial for the reconciliation of taxes withheld.

- Finish the form by signing and dating where indicated. The form must be signed by the employer or the person responsible for payroll.

- Once all fields are completed, review the document for accuracy. Ensure that all required information is present.

- Finally, save your changes to the form. Options to download, print, or share the completed document may also be available.

Complete your 499 R 3 form online today to ensure compliance and avoid penalties.

The 7% withholding tax applies to all professionals involved in a trade or business or which generate income in Puerto Rico for services rendered in Puerto Rico. The withholding applies to payments made to a health provider for health services rendered.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.