Loading

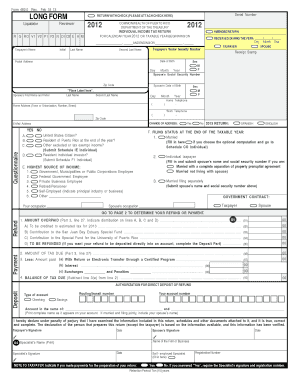

Get For Calendar Year 2012 Or Taxable Year Beginning On - Hacienda Gobierno

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FOR CALENDAR YEAR 2012 OR TAXABLE YEAR BEGINNING ON - Hacienda Gobierno online

This guide provides a comprehensive overview of how to complete the FOR CALENDAR YEAR 2012 OR TAXABLE YEAR BEGINNING ON - Hacienda Gobierno form online. It is designed to help users navigate each section and field of the form for accurate submission.

Follow the steps to successfully fill out the online form.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Indicate the taxable year at the top of the form by filling out the appropriate fields for the calendar year or the specific starting and ending dates for the taxable year.

- Complete the taxpayer's information, including name, social security number, date of birth, and postal address. Ensure accuracy in this section as it is crucial for processing.

- If applicable, indicate if the taxpayer is deceased during the year by filling out the date of death fields.

- Specify the taxpayer's filing status at the end of the taxable year by selecting the correct option, such as married or single.

- Provide information regarding the highest source of income by selecting the relevant category from the options list.

- Input the income details in the designated sections, including wages, commissions, and any other sources of income. Follow instructions for any required supporting schedules.

- Calculate the total deductions by collecting necessary information related to deductions applicable to the individual taxpayer. This may involve adding various categories such as mortgage interest, medical expenses, and charitable contributions.

- Review and complete the information regarding tax credits, if applicable, ensuring that all relevant forms are submitted where required.

- Final steps include checking for any amounts due or overpaid, along with selecting options for refund distribution if applicable. Save changes, download, or print the filled form for records.

To ensure timely filing, complete your documents online now.

While the Commonwealth government has its own tax laws, Puerto Rico residents are also required to pay US federal taxes, but most residents do not have to pay the federal personal income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.